A few years ago, talking about Blockchain was largely consistent with talking about the technology behind Bitcoin. In contrast, Blockchain nowadays comprises a whole technology branch, whereby the Blockchain itself can be implemented in lots of various ways. Not a year ago, on December 17, 2018, the peak of the Bitcoin hype was reached by the breakthrough of $20,000 per coin. With the Bitcoin hype also, the hype around the Blockchain was further fueled. Consequently, we now have over 1800 Blockchain Platforms with Cryptocurrency listed on coinmarketcap.com. In addition, there are numerous frameworks and providers for so-called Private Blockchains, which are mostly used in companies and consortiums. Therefore, I’ll give an overview in this blog article of the current development in Blockchain as well as its chances and risks. I’ll also deal with technologies such as Smart Contracts, DApps, DAOs and ICOs, which are possible or have grown through Blockchain.

Introduction

First, let me outline the structure of the article. I will try to explain everything in general, but due to the variations of implementations it’s not always possible. So please keep in mind first, that Bitcoin is not Blockchain but one possible implementation of a Blockchain and second, this blogpost is not about making fast money with Cryptocurrencies!

Additionally, the subheading indicates which question is dealt in the section. This allows you to directly navigate to all relevant topics. If you haven’t dealt with Blockchain yet or your knowledge is not yet fully consolidated, start with Blockchain Basics. If you want to know more about cryptography coins and why they will influence your life in the future, go to Cryptocurrencies. For all other Blockchain Uses Cases read Smart Contracts. If you are interested in Private Blockchains, read also Smart Contracts first. Nonetheless, I recommend reading everything for a comprehensive understanding. In the end of the blogpost you find my overall Conclusion.

What exactly is the hype around Blockchain?

To begin with we should clarify briefly that there are two hype about blockchain that need to be distinguished:

The first hype is the monetary hype, fueled by speculators and the possibility of making high profits in a short time through extreme price fluctuations. For many investors, the Blockchain technology is only a means to an end. In contrast there are also numerous startups just seeking for fast money with the hype. At so-called Initial Coin Offerings (ICOs) they try to collect money from investors for a new Blockchain platform including own currency, though some Startups do not have matured ideas. Conversely, investors are hoping for a hype around the new currency to earn a lot of money. This dubious moneymaking is entirely favored by the lack of controls and rules. I will not go into more detail on the monetary hype in this blogpost, but on the chances of Cryptocurrency and on ICOs.

The second hype exists around the Blockchain technology and the possible disruptive effect on all branches of industry. The hype is driven primarily by large companies, ahead of the game management consultants (Deloite, Accenture, …) and participators in large Blockchain projects (JP Morgan, IBM, Daimler, …). [1] It almost seems that everyone is compulsively trying to do something with Blockchain and is best involved in its development. Large banks such as Commerzbank also see their existence threatened and are setting up subsidiaries and startups to deal with the subject.

Blockchain Basics

Who invented Blockchain?

The origin lies in the 2007 financial crisis and the resulting loss of confidence in banks. A person or group hiding behind the pseudonym Satoshi Nakamoto published 2008 as a reaction the Bitcoin white paper. It describes a peer-to-peer electronic cash system working without intermediaries like banks. The underlying mechanism of Bitcoin is called Blockchain, even though the term itself did not appear in the 2008 white paper. [2]

What problems does the Blockchain solve?

Imagine you want to exchange money digitally with your friend without using an intermediary, such as a bank. However, trust in your friend is limited, so you don’t want to use a system from him and also he don’t want to use a system from you either. This is exactly where the Blockchain comes into play: It enables the exchange of data based on algorithms and cryptography without requiring trust in participants. In case of a financial system it is not possible to spend money multiple times (double spending problem) or to create money in an unforeseen way (forgery problem). In the case of a traditional financial backend, like the ones run a bank, it could be possible to manipulate the database at any time by the owner. With the Blockchain technology this is impossible.

What is a Distributed Ledger?

While reading about Blockchain we often see the Term “Distributed Ledger” or DLT (Distributed Ledger Technologies). A Blockchain is basically a possible implementation of a distributed ledger. However, the term is rather used as a synonym for Private Blockchains. DLT is generally understood to mean technologies that use Blockchain-like mechanisms. An example of this is Iota, which uses acyclic graphs instead of linear chains. These terms are mainly used in the industrial environment and in business consulting.

How does the principle behind Blockchain work?

To understand the principle behind Blockchain I recommend to take a look at the notebook example, for instance here: https://www.upfolio.com/ultimate-blockchain-guide.

For those of you who already know it, I’ll repeat it in a nutshell:

Imagine you have your own currency with your friends Alice and Bob. Each of you has a notebook, whereby the individual pages correspond to the blocks and the spiral binding to the concatenation of a Blockchain. Will Alice now give Bob money she creates a transaction with the details and passes them on to all participants. By Alice’s signature and her current balance, we can check if the transaction is valid and write it to the current page in the notebook. Transactions are added until the page is full. Now all parties must check whether everyone has written down the same transactions. Since a direct comparison of each individual transaction is too complicated, it is agreed on one version of a participant’s page. Therefore, a so-called consensus algorithm is used, which artificially complicates the conclusion of new sites and thus helps securing the Blockchain. As a result of the consensus algorithm, a fingerprint (hash) is calculated from the chosen site. By writing this fingerprint on top of the next site, we chain everything in a non-modifiable way together. Since manipulating pages in past would cause to recalculate all fingerprints of the following sites, the Blockchain gets immutable.

All in all, we have three main characteristics that are decisive for the Blockchain:

- signatures and transaction validation

- the consensus algorithm

- chaining by hashes

id=”transaction-validation”How does signatures and transaction validation work?

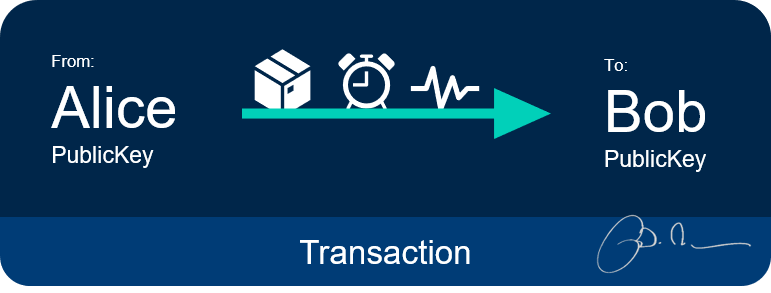

In general, a transaction is a new entry to the database, the Blockchain. In order validate the transaction, it requires a mechanism that allows the transaction to be validated without having to contact the creator of the transaction. To achieve this, asymmetric cryptography with a public/private key pair is used. To simplify the following steps, we will take a payment system as an example. As with classic central systems such as Paypal, we needed an address to which we wanted to transfer the money. For Blockchain we use the public keys of our key pairs as the address. As with an account, you can also query how much money is currently on the public key by adding the outcome of all transactions written down. Thus, a transaction describes the transfer of money from one public key to another. The key point is the signing of the transaction with the sender’s private key. Since the sender address is the corresponding public key, the transaction can be checked independently for authenticity by using the sender address for validating the signature. In the case of our example payment system, we must also check whether enough money is deposited on the public key used. Other Blockchain systems may have some additional checks, too.

How does the consensus algorithms work?

The consensus algorithm specifies the rules how new blocks are added to the chain. The decisive factor here is that it is made as difficult as possible or impossible for individual participants to add new blocks to the chain, but possible in collaboration for the majority of participants. In connection with the chaining of blocks via hashes, previous blocks are secured, since a change in a previous block would require a renewed agreement with most participants on all subsequent blocks.

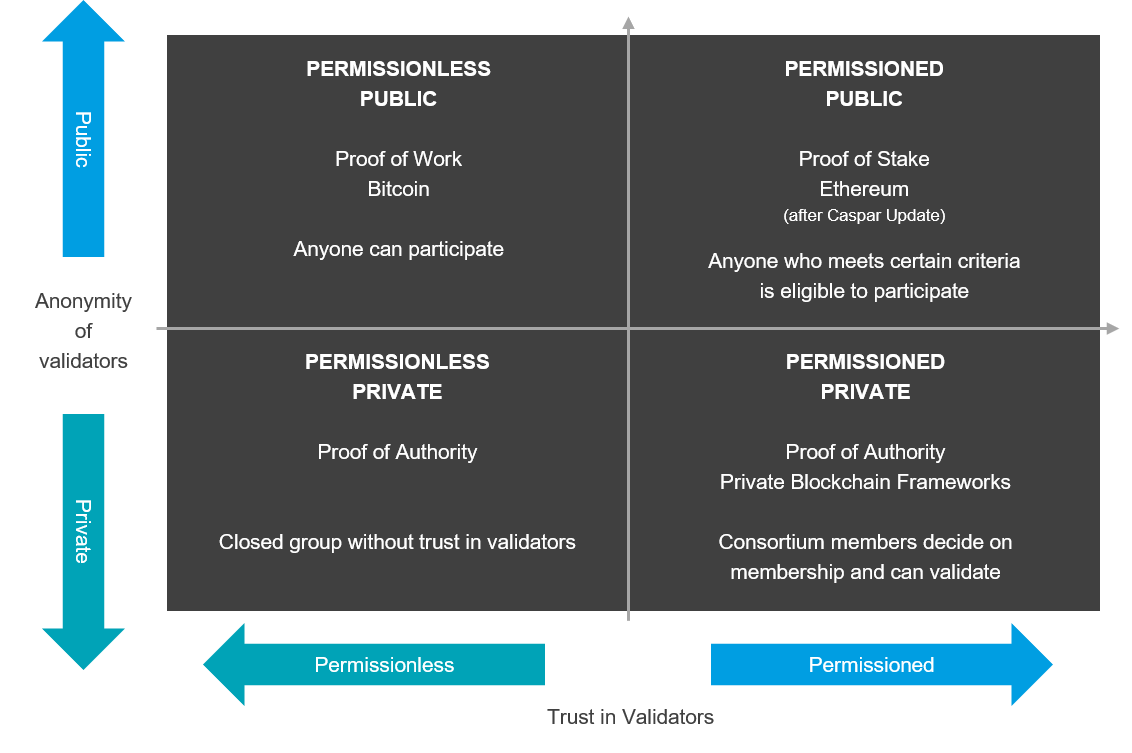

The most widely used algorithm for Public Blockchains is Proof-of-Work, which is used by Bitcoin among others. To add a new block to the chain, a complex puzzle that requires a lot of computing energy has to be solved. This process is also known as mining (digging coins using hardware), as the validators are rewarded for it. The algorithm does not directly work with the number of participants but with their computing power. If no participant has the majority of the computing capacity in the network, nobody can solve the puzzle faster than the network as a whole. However, if a participant has the majority in the network, he can create valid blocks faster or as fast as the network and consequently create alternative chains, respectively alternative truths. For more details take a look at the bitcoin white paper: https://bitcoin.org/bitcoin.pdf [2]

Since Proof-of-Work is not the best solution, it will gradually be replaced by Proof-of-Stake in the future. The second largest public crypto platform Ethereum has already started to introduce the alternative algorithm. Proof-of-Work virtualizes mining by requiring participants to deposit a financial stake, which is frozen in case of malicious behavior. As with Proof-of-Work validators also receive a reward. To get more in the known, look here: https://github.com/ethereum/wiki/wiki/Proof-of-Stake-FAQs

Depending on the use case of the Blockchain, different consensus algorithms are used. For Private Blockchains, Proof-of-Authority is usually used in conjunction with a Byzantine Fault Tolerance algorithm. In this case, the rights to create new blocks are given in advance to participants. With the Byzantine Fault Tolerance algorithm is checked whether one of the participants performs malicious actions.

Beside the presented algorithms there are some more, for instance Proof-of-Activity. [4] [5] [6]

Which parties usually exist in a Blockchain?

Basically, it needs several full Nodes, which form the Blockchain Network and manage copies of the Blockchain. However, to participate in a Blockchain network such as Bitcoin, you do not need to operate your own Node, only a wallet with a valid address is required. To get the transaction into the Blockchain network, you just need to send it to a participating Node. To be involved in mining, the so-called earning of coins by taking part in the validation process, an independent full Node must be operated. Full Nodes are also known as Miners or validating Nodes. Light Nodes do not download the complete Blockchain but can be used to check the signatures and headers of new blocks as well as for adding new transactions to the network.

What fundamental problems does the Blockchain have to face?

The following problems have already been solved or have at least been solved theoretically and to some extent by individual platforms. Nevertheless, they’re still hotly debated in the Blockchain scene.

- high scalability and throughput

- slow consensus algorithms resulting in slow transaction rates

- endless growing blockchain size due to it’s immutability

- masses of redundantly executed code for Smart Contracts [8]

- good consensus algorithms are needed

- privacy

The GDPR includes the “Right to be Forgotten”. How can this work in conjunction with the Blockchain?

Summary – Blockchain Characteristics

To sum up, we can find the following seven core properties of the Blockchain in general.

The Blockchain is

- decentralized – no central authority controls the network

- available – there are still other Nodes if one Node fails

- immutable – changes cannot be made, nothing is deleted

- non-repudiable – a signed transaction cannot be denied by the signer

- ownable – all assets (e.g. tokens) in the Blockchain are owned by someone with the corresponding private key

- transparent – all transactions are visible to everyone

- consistent – after a certain number of blocks, depending on the protocol, the Blockchain receives a strong consistency

Cryptocurrencies

In the past year, the number of Cryptocurrencies listed on coinmarketcap.com doubled. Driven by the financial hype at the end of 2017, numerous startups launched Blockchain platforms with their own currencies. The currency itself is often only a means to an end, since the platforms pursue other goals, for instance in the field of eHealth. Others also use the hype to start pointless projects and earn money by selling the projects Cryptocurrency.

Why are currencies on Blockchain actually called Cryptocurrency?

Due to the use of asymmetric cryptography for transactions. To get about this, read: How does signatures and transaction validation work?

What are the advantages of Cryptocurrencies?

The biggest advantage is disintermediation – we do not have a need for a central authority to be trusted anymore. Therefore we trust now in cryptography, algorithms and the presence of many honest participants.

Not everyone in the world has easy access to a bank account. However, a wallet can be set up quickly and for everyone, so that unbanked people also have the chance for an account, a crpyto wallet. If the hype has subsided a bit and the prices of the Cryptocurrency are more stable again, online shops and services will accept Cryptocurrency again and by this unbanked people have a better access to them.

What problems do Cryptocurrencies have to face?

Driven by the hype, the prices of the Cryptocurrency are currently very instable. To make an alternative currency successful in the long term, it needs stable exchange rates, so that online shops and services enable Cryptocurrency as a means of payment.

Depending on the consensus algorithm, currencies have a very high energy consumption. Especially with Proof-of-Work, we have a big problem. Bitcoin consumes alone 73 TWh per year, this is as much energy as Austria needs per year. Calculated down, a single transaction causes approximately 450 kg CO2. This corresponds to over 2500 km with a new gasoline car. [9]

But not only the pollution is a problem at Proof-of-Work. If miners have the majority of more than 51% computing capacity in a network, they can exert 51% attacks and cheat. Smaller currencies such as Bitcoin Gold, ZenCash or Krypto Verge have already been victims of such attacks. [10]

One of the biggest challenges will be questions about legalization and restriction. Many of the crypto trading markets are subject to little or no control. Cryptocurrency are used for criminal purposes such as blackmailing with ransomware. Even if the trading of crpyto money within the Blockchain network works well, the question, how users can convert the crpyto money into public money as well as who guarantees and takes over security here, remains.

So even if the giant Bitcoin has a 53% crypto market dominance, we should also consider another Cryptocurrency. In other words, the question we need to ask ourselves is:

How can we succeed in developing an environmentally friendly, secure, anonymous and price stable crypto currency?

Smart Contracts

What is a Smart Contract?

A Smart Contract is a protocol or program code that can be used to map, automate, and support contracts. In the case of the Blockchain, the Smart Contract must be stored as executable code in it. Changes to contract contents can automatically trigger actions so that manual checks are no longer necessary. As with all operations on a Blockchain, all updates, including the deployment of the contract itself, must be inserted as transaction. [12]

The main differences to conventional contracts are the elimination of third parties, the automated execution of activities or checks as well as the automated informing of all participants about status changes.

For instance, Smart Contracts can be used for supply-chains, elections, leasing contracts or notarial transactions. In Ghana the land registration was put on the Blockchain, because of difficulties in contacting notaries and unresolved property claims. Therefore, the NGO Bitland proofs the ownership of land and stores the result in a Blockchain. [20]

Which blockchains can manage Smart Contracts?

Ethereum is the most popular Blockchain, which offers a wide range of possibilities for the design of Smart Contracts. Therefore, the special Turing-complete language Solidity was created. Ethereum executes the program code in the Ethereum Virtual Machine. To prevent badly programmed code from running indefinitely (for instance in loops), Gas is required for each execution. Gas must be purchased with Ether and is consumed by Smart Contracts CPU usage. With Ethereum and its possibilities in Smart Contracts, DApps, DAOs and ICOs have grown and developed. [12]

Another well-known one is the EOS platform which has been recently launched. It is called the Ethereum killer due to better algorithms and higher scalability. But even Bitcoin can run a kind of Smart Contracts, so for instance Bitcoins can be frozen for a certain time. A list of Public Blockchain platforms supporting Smart Contracts can be found at [14].

Beside the public platforms there are numerous frameworks for building Private Blockchains. As a rule, the goal of all Private Blockchains is the automated handling of contracts and processes. Hence, these frameworks are completely geared to Smart Contracts.

What is an Initial Coin Offering (ICO)?

An ICO is a kind of crowdfunding via Smart Contract on the Blockchain. To set up a new Blockchain platform or Cryptocurrency, tokens are sold with a Smart Contract. For instance, the now independent EOS platform started selling ERC20 tokens in Ethereum in 2017 and thus collected money for development (look here if you want to code your own token contract: https://www.ethereum.org/token). At the start of the EOS main network in 2018 the ERC20 tokens on Ethereum have been frozen and exchanged for EOS tokens, the currency of EOS. Anyone who participates in an ICO will later receive shares of the new platform in the form of tokens. As usual with crowdfunding, a certain amount of money has to be collected in a certain time. The Smart Contract ensures, that if the target is not reached, all income is automatically repaid to the creditors. [15] [16]

ICOs allow everyone to easily start their own crowdfunding. Investors can obtain certain securities such as automated transfer of units or automatic refunding if reaching the target fails. No intermediary is necessary, which also enables anonymous foundings. However, depending on the use case, confidence in the startup and its developers is still needed in the end, since only tokens but not promises can be secured via the Blockchain.

What is a Decentralized Autonomous Organization (DAO)?

A DAO is an organization that is fully autonomous managed by its members. The central connection is a Smart Contract on a public Blockchain for participating and voting on decisions in the DAO. To become a member eligible to vote of the DAO, shares in form of tokens must be purchased. Suggestions and opinions are usually exchanged via forums or other third ways, the vote on the implementation of these then takes place on the Smart Contract. In contrast to traditional organizations, a DAO does not require central management and members can participate anonymously. However, as soon as these organizations carry out activities that require a connection to the real world, people who become trusted are needed. In this regard check out the Real-World-Blockchain-Gap. [14]

What is a Decentralized Application (DApp)?

DApps are autonomously operating, open-source and via tokens controlled applications. All changes to the app must be made by the users, whereby no user may have the majority of voting tokens, similar to DAOs. Therefore, the storage of data in a public decentralized Blockchain is necessary. Thus, it possible to design applications which exist without a central authority. As a matter of fact, Bitcoin itself is a DApp, as it offers an open-source financial service based on the blockchain. We can be curious to see which DApps, or more precisely which services based on DApps, will influence our lives in the future. For further information I recommend [17] and [18].

Why are Cryptocurrencies so successful, but other applications on the blockchain not yet? Or: The Real-World-Blockchain-Gap

Let’s take therefore a look on the Ghana land registration Bitland. Unfortunately, there is not much information online how the Bitland blockchain works, but in one of their advertising texts they write that it is used for secure storage in stone. The key question we must ask ourselves in this case is: Who participates in the Blockchain network and checks that no malicious activities are performed? If only Bitland itself operates a Private Blockchain, the Blockchain can be modified by Bitland. Bitland will also probably make all changes to the land legislation. As a result, the actual goal of disintermediation is not achieved. Also, the advantage of ownership is no longer given. Instead, it would be exciting if the landowners were the owners of the private key, which represents a piece of land in the Blockchain. Thus, if land is sold, the landowner would have to sign the transfer in the Blockchain himself. But in the end, we still have some unresolved problems: What if the landowner loses his private key? What if the landowner has already received some money for selling his land but refuses to update the entry in the Blockchain? [20]

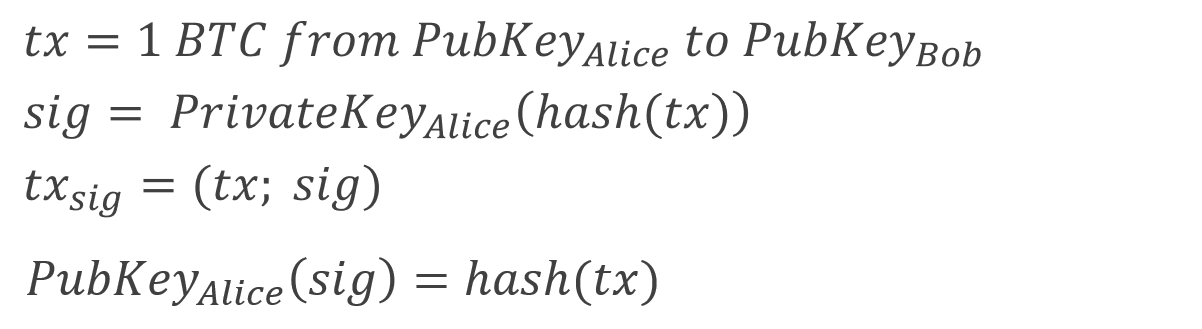

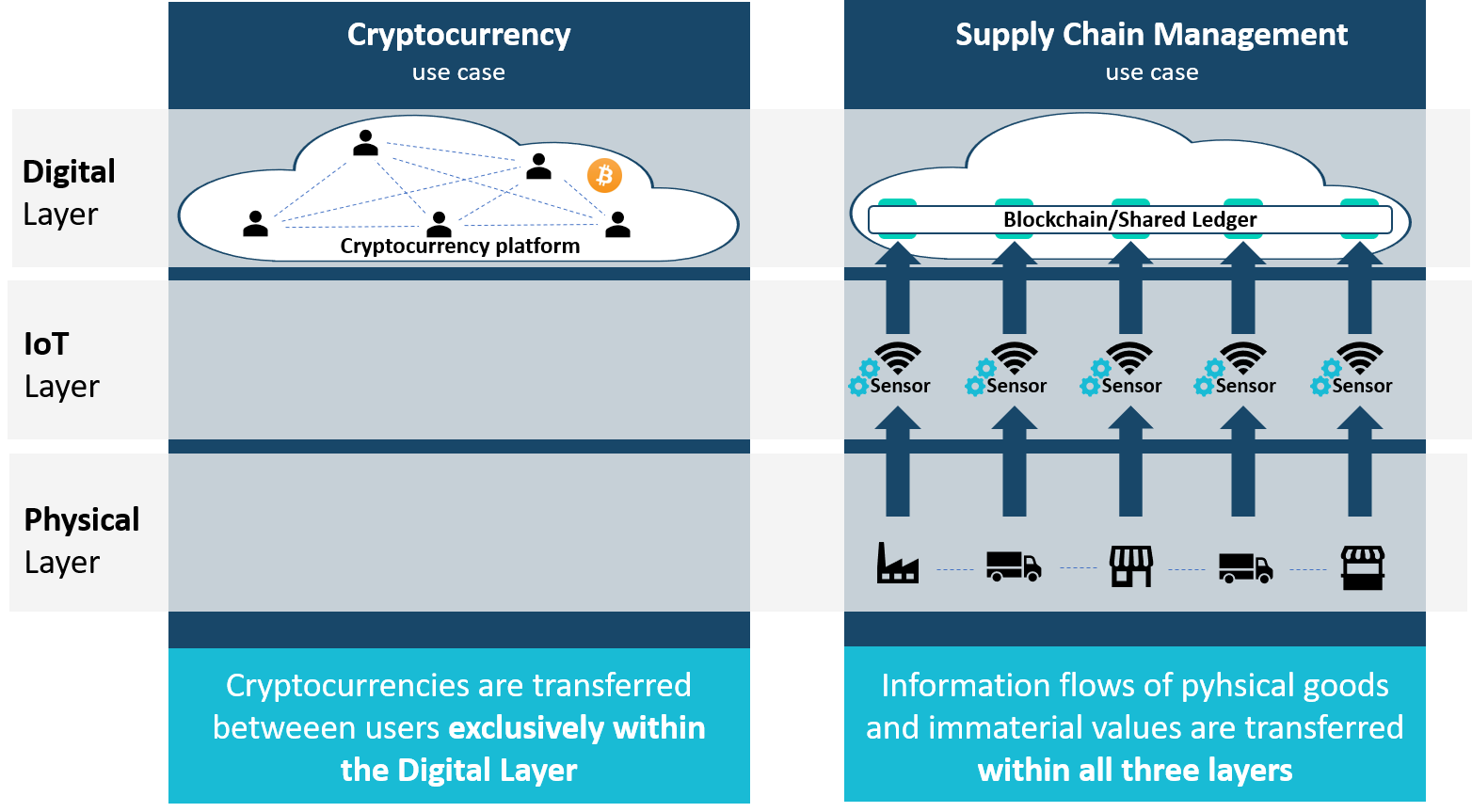

These Problems are caused by the Real-World-Blockchain-Gap. Cryptocurrencies don’t have such a problem, because all assets (the coins) are assets in the Blockchain. Other use cases than currencies need to fill this gap with intelligently used technology or by reducing the risk for fraud.

The validation of transactions consists of two parts: On the one hand the verification of the signature and on the other hand the check for plausibility of the content. Since crpyto coins are only traded within the blockchain, the plausibility can be validated by checking whether there are enough coins on the public key available. If users enter data into the blockchain from outside, plausibility validation is no longer possible because validators cannot access deterministic data outside the blockchain.

In other words, we need to understand whether we can minimize the risk of malicious attacks using IoT devices in such a way that the effort involved in operating a Blockchain is worthwhile, compared to traditional systems.

Private Blockchains – Distributed Ledger Technologies

The terms Private Blockchain and Distributed Ledger Technologies are used synonymously in this article for simplicity. In fact, not all the technologies presented here are Blockchains, but belong to the Distributed Ledger Technologies category.

What is a Private Blockchain?

In the bottom row are the Private Blockchains. When we talk about them, we usually talk about the bottom right: Permissioned Private Blockchains. Members of a consortium can choose who can join them and choose the validators. There is a certain level of trust in the validators, however the companies are reviewing each other. As described, Private Blockchains usually use Proof-of-Authority with a Byzantine Fault Tolerance algorithm. Basically Proof-of-Authority is nothing more than in advance granted rights to validate blocks. In addition, the byzantine algorithm checks the validations for anomalies. Private Blockchains are mainly used for automation and hedging of contracts and trades by using Smart Contracts. [21]

Private Blockchains are usually implemented with frameworks like Hyperledger, Quorum or Corda. If you want to know more about companies driving these frameworks forward checkout Avasant’s Blockchain Radar View [1].

What are the decisive advantages of Private Blockchains?

Private Blockchains enable collaboration over Smart Contracts for companies with a varying level of trust. In contrast to classical shared non-blockchain systems and databases, all participants get automated an immutable copy of the data with them. Thus, manipulations of individuals are excluded. In summary, the automated exchange of all data in an auditory system, which does not allow any subsequent changes, is the decisive advantage over non-blockchain systems.

Where will Private Blockchains really have a disruptive effect?

This is probably one of the most difficult questions in Blockchain. Especially in connection with the previous question, what the decisive advantages of private Blockchains are, the varying level of trust is a decisive criterion for me. I don’t think that large companies that are already working together and have reached a certain level of trust have the need to switch to a Blockchain. However, it is much more interesting in cooperation with less trusted companies, for instance from emerging or developing countries. Just as cryptocurrencies can have a disruptive effect by making digital means of payment available to unbanked people, Private Blockchains can hedge contracts and trades or make trades even possible for the first time.

However, with the Blockchain and Smart Contracts we will never be able to eliminate all risks, so the interesting question is:

Is it really worth the more security by the Blockchain, with all the drawbacks such as complex implementations and poorly scaling systems?

Conclusion

Because it is very difficult to give a general conclusion about Blockchain, I recommend looking for the appropriate question in the blogpost if you want to know more in a special Blockchain topic.

All in all, Cryptocurrencies have the best chances for successful disruption. These act in the digital layer and therefore do not have the Blockchain-Real-Word-Gap problem. For all other use cases, I am clearly more pessimistic and curious about how it will develop in the next years. I don’t think Blockchain will disappear out of sight – quite the opposite. In a few years we will be thinking about the Blockchain as an alternative to a classic server system in selected projects. However, a lot of what we are currently experiencing is the hype and the attempt to sell an immature technology to companies.

Complete insanity is the financial hype. In a short-time this brings money to the Blockchain community, nonetheless in the long run it will damage Blockchains reputation.

Resources

For all resources: Last accessed on 2018-08-22

[1] https://www.lntinfotech.com/wp-content/uploads/2018/08/Avasant-RadarView-Blockchain-July-2018.pdf

[2] https://bitcoin.org/bitcoin.pdf

[3] https://github.com/ethereum/wiki/wiki/Proof-of-Stake-FAQs

[4] https://eprint.iacr.org/2014/452.pdf

[6] https://counterparty.io/news/why-proof-of-burn/

[7] https://github.com/ethereum/wiki/wiki/Sharding-FAQs

[8] https://www.multichain.com/blog/2015/11/smart-contracts-good-bad-lazy/

[9] https://digiconomist.net/bitcoin-energy-consumption

[11] https://blog.ethereum.org/2016/01/15/privacy-on-the-blockchain/

[12] https://github.com/ethereum/wiki/wiki/White-Paper

[13] https://github.com/Overtorment/awesome-smart-contracts

[14] https://www.ethereum.org/dao

[15] https://www.investopedia.com/terms/i/initial-coin-offering-ico.asp

[16] https://www.ethereum.org/crowdsale

[17] https://github.com/DavidJohnstonCEO/DecentralizedApplications

[18] https://blog.ethereum.org/2014/05/06/daos-dacs-das-and-more-an-incomplete-terminology-guide/

[20] http://landing.bitland.world/

[21] https://blog.ethereum.org/2015/08/07/on-public-and-private-blockchains/

[22] https://www.multichain.com/blog/2015/11/avoiding-pointless-blockchain-project/

[23] https://blockchainhub.net/blockchains-and-distributed-ledger-technologies-in-general/

Leave a Reply

You must be logged in to post a comment.