Everyone interacts with it, often on a daily basis, everyone is part of it and everyone will suffer from the consequences of a crisis hitting the system, but only few reap the benefits. The financial system has become huge and ominous, it is hard to understand how it works or even fully comprehend it. This article shall give a little insight on the financial system and its shortcomings.

The financial system on a timeline

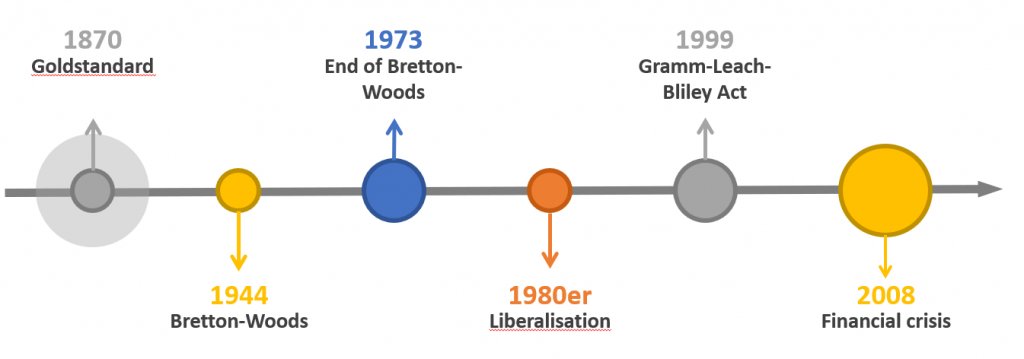

To understand the financial system and identify possible weaknesses it is important to understand how it evolved and on which base the system is founded. The beginning of the global financial system could be marked by the introduction of the gold standard. Currencies were backed by gold and therefore had a value within them, the actual gold value. Of course earlier gold coins were commonly used as a currency, this had the advantage of the value of the currency being within itself, it was money with an intrinsic value, a value within them. But it was easier to use currency instead of gold coins, as large sums would also be quite heavy. With the gold backed currencies trade could be made globally, since every currency had a value in gold.

In the year 1944 the world was suffering from the second world war, all major global players were involved in it, and apart from the cost of such a war it had other financial repercussions on the system as well. These repercussions are still deep within the financial system today. As the United States didn’t have to fight the war on their own soil, and attacks on US soil occurred very rarely the economy of the States didn’t take as much of a hit as European countries. The United Kingdom was a frequent victim of german bombers and thus really suffered from destruction of production plants. This meant that the United States economy was doing good, given the circumstances, while the economies of the other global trading nations were ravaged. Additionally the United States were researching the atomic bomb, and in the year 1944 were already a huge military powerhouse, paired with their stable economy, the biggest internal market at the time and the largest gold reserves the United States pulled a stunt which would make them the financial and economical world leader. They introduced the Bretton-Woods system, in this system all other currencies were linked to the US-Dollar as anchor currency, while the US-Dollar was linked to gold with 35$ per ounce.

However in the following years the demand for money was ever increasing, the need for oil increased and the Vietnam war was costing copious amounts of money. The ration between the US-Dollar and the gold in the United States was decreasing rapidly, which lead the President Nixon to release the US-Dollar from the gold. With this came the end of the Bretton-Woods system and every currency was released from the backing of gold. The United States singlehandedly removed the foundation of the financial system with this step, for now every currency became fiat money, which is money without an intrinsic value. The value of the money now lies within the dedication of the system to recognize its given value, it has no connection to any real value whatsoever anymore.

Still the US-Dollar retained its important position within the financial system, one reason for this is the deal, the United States made with Saudi Arabia. The US provides weapons and military protection for Saudi Arabia and in turn the monarchy ensures that oil can only be traded in US-Dollars, worldwide. This deal was and is protected with every force possible, the regimes of Hussein and Gaddafi weren’t broken because of their tyranny, but in huge parts because they tried to sell oil through another currency.

The financial system was liberated more and more, rules were lifted in favor of financial institutions, politicians like Clinton in the US and Thatcher in the UK pushed the deregulation of the financial system and released the institutions from its chain, unleashing the monster that is now our financial system. In 1999 banks were allowed to enter the investment business unrestricted and just one year later the trade with derivates was allowed. Derivates are somewhat bets on future prices and don’t really have a value based on an actual product. In addition the globalisation led to moving the production in cheap countries, which in turn increased the imbalance between real economy and financial economy. This will be explained in more detail later.

From now on the financial system could make money from money, without any connection to real products. Speculations leads to earnings higher than it would ever be possible in the real economy and thus the investments in this financial casino are ever growing, even states take part in this gamble. This can lead to speculation bubbles, the last famous bubble popped in 2008 and lead to a worldwide financial crisis, with repercussions still noticeable today.

The creation of money

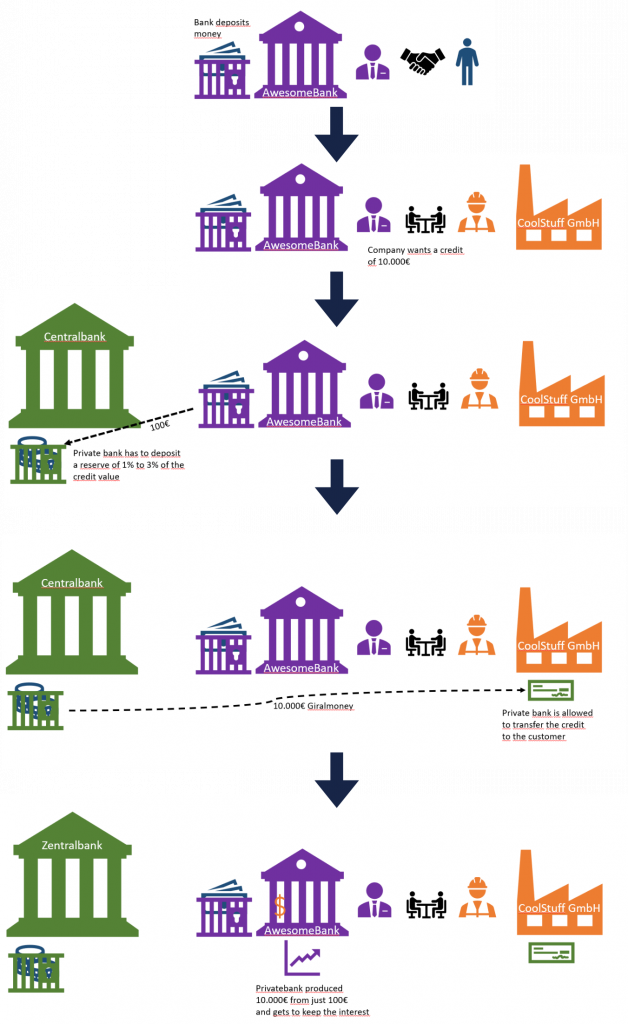

To understand dangers of the system it is imperative and also quite interesting to know how money is created in our financial system, how does more money get into the system. This can be described very well using an example. Imagine a person deposits money at a private bank, the bank will keep this money for an agreed amount of time and after that time is over the person can get the money back including interest. Now what you’d normally think is that with the deposit the bank will now use this money to give out loans or invest it otherwise. However this is not how it works, as the money deposited wouldn’t suffice, the demand for low interest credits is far too high to satisfy its demand just with deposited money from private customers.

So what happens if the company wants to give out a credit, let’s assume a company wants a credit of 10.000€. In order to do this the bank will have to deposit 1% to 3% of the credit sum at the European Central Bank, this will be payed with the private deposits the bank has. After the deposit is done, the private bank is allowed to directly give the company the credit sum of 10.000€. The bank will receive interest for the credit and basically made 10.000€ out of 100€ of its own capital. The creation process of money is basically privatised as any bank can do this. Since the money given out isn’t the money of the private bank they also don’t really have any risk.

Realtion between the real economy and the financial sector

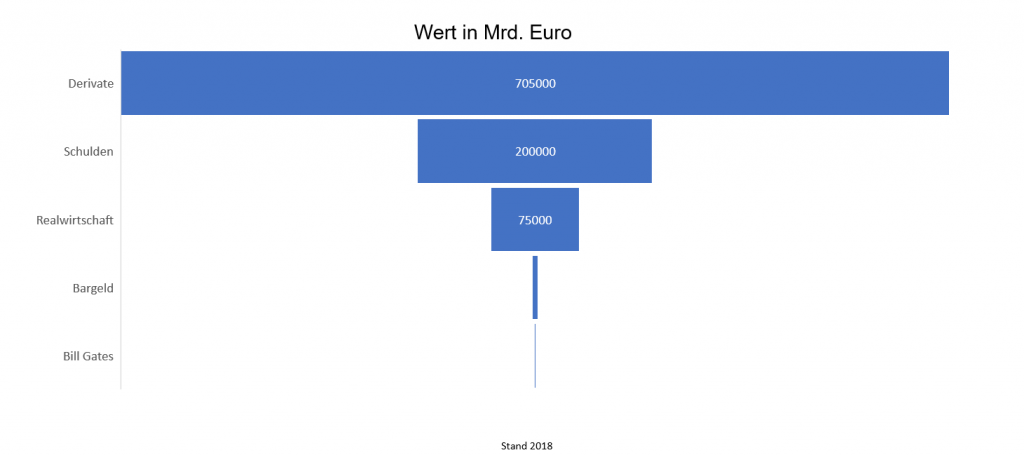

As one would imagine the size of the financial sector should be somehow aligned to the real economy, so that the money which is in circulation is still based on actual products. A relation between the real economy and the financial sector is important, because if this relation is broken the financial market is pure gambling. To put this in perspective, consider the following:

The figure below displays the value of different branches, Bill Gates holds stocks worth about 65 billion euros. The sum of cash in circulation is about 5 trillion euros. Now the real economy, all products and services provided are worth 75 trillion euros. The sum of all total debt is 200 trillion euros, and the volume of derivates traded is 705 trillion euros, nearly ten times the worth of the real economy. This highlights how far apart the real economy and financial economy are nowadays.

Additional dangers and shortcomings

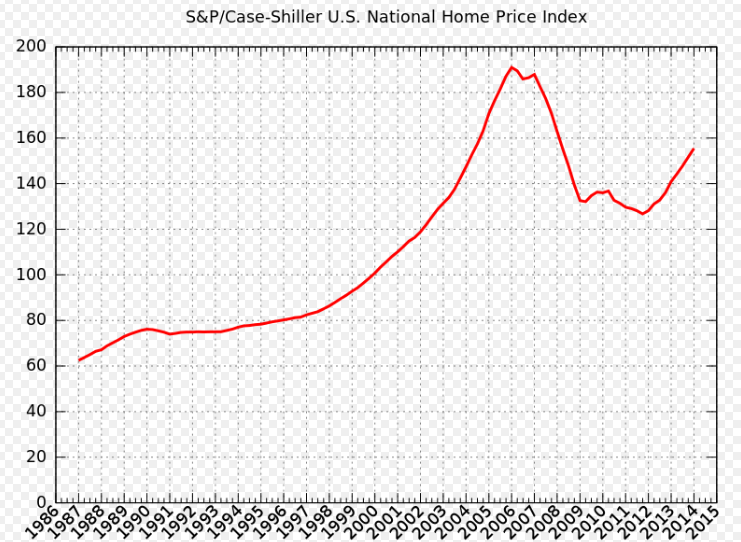

As it happened in the financial crisis of 2008, cheap money can lead to speculation bubbles. This danger is still very relevant today, as it seems not much was learned. If we look at the prices for real estate, and its progression (figure below) we can see that it is inflating a lot again. Real estate is used for speculation, because the prices are almost guaranteed to not drop. Combine this with the ability to get cheap credit rates and we have a recipe for a speculation bubble that is bound to burst.

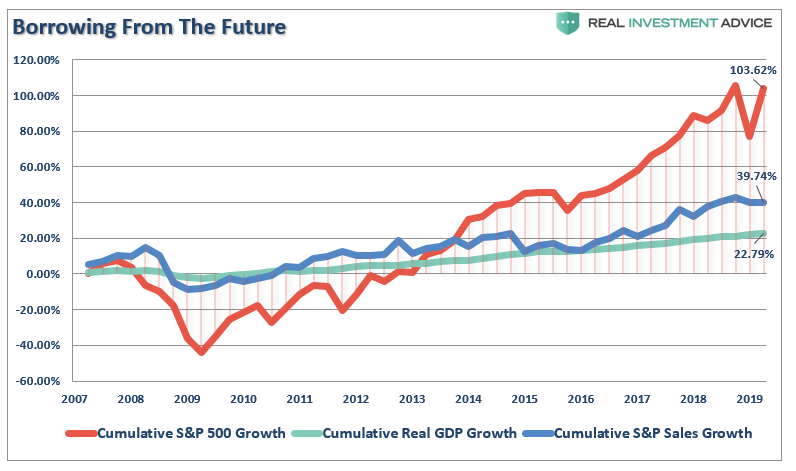

Not only Derivates are far away from being connected to the real economy, but also the stock market. The difference is, the stock market should be closely related to the real economy, because if the economy isn’t doing well, than the companies at the stock market aren’t doing will, which normaly resulted in a drop. But instead the stock price growth was rising at a steeper rate than the GDP growth. Displayed in Figure 3 is the S&P 500 growth, this describes the stock price growth of the 500 largest stock companies in the United States. The blue line shows how well these companies performed in their respective markets, and the green line shows the growth of the GDP in the US. Normally these three line should show a very similar growth. Because if companies are doing well in their markets, the GDP will increase and of course the stock price should increase as well. However if companies are not doing well and Sales are dropping, so does the GDP and so should the stock price. While we can see this a little, we can also observe the very steep growth of the stock prices, which is where the stock market lost its relation to the real economy. This is partly because the stock prices nowadays are inflated by the cheap money from the federal reserve, in order to keep them stable and prevent a crisis like in 2009, where the prices dropped by a huge amount. To keep the stock market from crashing horribly the reserve banks are intervening and keeping the prices on the rise. This means that nowadays the price for a specific stock is not determined by the usual performance of the company, the supply and demand but instead it is depending on what the Fed is doing.

With the low interest policy of most central banks, most credit rates are bound for 10 or more years. This means if a private persons takes a credit for building a house, the initial interest will stay for more than ten years. This is fine as it is today, but if the economy takes a hit, and interest rates increase suddenly, banks can’t cope with it, because the long fixed-interest-rate prevents them from increasing the interest rate as well, which in turn could lead to bankruptcy, because they have to lend money with a lot higher interest rates, but are getting a lot less.

Now most of the outlined shortcomings and dangers up until now, are in the system for quite a while. The roots of the financial system are pretty old, and even though it isn’t perfect it seems to be working. So one might ask, what’s the problem then? If it works it’s not broken, or never touch a running system. And yes the system does work, so far at least. But because of its weaknesses it could break, and this could be fatal. The financial system is far from perfect, it benefits the few and lies on a foundation which was removed decades ago, it grows larger and larger, because the greed of mankind seems to be insatiable. All it would take for it to fail and fall into pieces could be a major, global crisis, like a world war, an alien invasion, or a global pandemic.

Current impact of the corona crisis

The corona crisis is in many ways unique, the modern world has never faced a crisis like this, and it will impact each and everyone in some way or another. The financial system is not spared of course, and it is quite interesting how the corona crisis affected it.

Most notably the stock market crash, never before has the stock market taken such a big hit in such a short amount of time. In less than a month the markets dropped by 39%, its never been so fast. Markets reacted to lockdowns and less consumption. The world awaited a long lasting recession, poverty and stagnating stock prices. Instead something miraculous happened, the stock market recovered very quickly. Some stocks are listed even higher than before the corona crisis hit, many stocks are almost as high again, and the indexes are also close to recovery. But still, the repercussions of the crisis are not yet fully known, lockdowns and restrictions are still in place in several places, many people lost their jobs and a close to drift into poverty, private consumption has decreased because of this, companies have gone bankrupt. The real economy has taken a huge hit, the GDP has shrunk already and it is expected to shrink for more than 6.3 %, probably even more. Why do the stock markets not care than? Do investors not realize what crisis companies are currently in? They do. But the stock market is stabilized by the Federal Reserve, by actively buying in the stock market the prevent a huge crash like in the financial crisis and the following recession. Without this aid, the markets could collapse, to not risk this an infinite amount of money is pumped into the system everywhere. Because no one would know what would happen if the system collapses.

To sum it up, right now the system is still stable, which of course is because of the billions of money that is pumped into the system by the central banks, and they have the power, in theory, to do this endlessly. Everything hinges on the system not to collapse, but the question is can the system sustain such an amount of money pumped into the system, in such a short time? Only time will tell, we can only hope to learn from our past mistakes, for else the worst could happen.

Conclusion and thoughts on the current situation

The system today relies on growth, on economic growth, endless growth. It is simple really, if the GDP increases, the economy grows and the total amount of money in the system grows accordingly. This leads to prosperity for everyone, which is why economic growth is one of the most favorite buzzwords for politicians to use. The problem is, we live in a finite environment, our planet has a finite amount of resources, at some point everything is used, and logically there can’t be anymore growth. Still everything is geared towards everlasting growth, stocks are listing at heights unimaginable just a decade ago, with no real end in sight. Investors are investing like crazy, low interest rates support investing and bloating the system even more.

Today we have a crisis like never seen before, the pandemic takes a heavy toll on all companies worldwide. Sales of many products are going down, employees are fired or are getting less money, unemployment is rising steadily and we still don’t really know what the situation will be like in a few months. The times are very uncertain, and the GDP is decreasing, seems like the system can’t grow endlessly. A crash is certain, people are keeping their money with them, we will drift into a recession. But no, actually the financial sector seems to not be aware of corona. Asset prices are still increasing, stock prices are increasing, investment companies are still investing like crazy. What is actually happening.

In 1989 something happened in Japan, the stock market in Japan crashed tremendously, because of overvaluation of a lot of Assets. A bubble burst, like a bubble burst in 2009, and several other times. What sets Japan apart however, is that the market in Japan has not recovered from that crash to this day. Investment companies would still have lost money until this day, if they invested in 1989 and kept their investments until today. That’s bad especially for the big banks, and therefore the whole financial system.

So it seems like the central banks are doing everything to can, to not let a crash like this happen. Because the system is already bloated, and the bubbles busting just now, would be catastrophic. So more money gets pumped into the system, to keep the prices up and the bubbles from bursting. Maybe that’s a good thing, no one really knows what a collapse would result in. But the ones benefitting from this behavior are big financial institutions, and the ones paying for it are the John and Jane Does.

References and interesting reads

https://www.bundesbank.de/de/aufgaben/themen/finanzstabilitaetsbericht-814862

https://www.researchgate.net/publication/271703327_The_German_Financial_System

Dokumentationen

https://www.planet-schule.de/sf/php/sendungen.php?sendung=10690

Leave a Reply

You must be logged in to post a comment.